Condo Insurance in and around Ogden

Get your Ogden condo insured right here!

Protect your condo the smart way

Condo Sweet Condo Starts With State Farm

As with any home, it's a good plan to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has terrific coverage options to fit your needs.

Get your Ogden condo insured right here!

Protect your condo the smart way

Agent Jay Carnahan, At Your Service

With this insurance from State Farm, you don't have to be afraid of the unanticipated happening to your condo and its contents. Agent Jay Carnahan can help inform you of all the various options for you to consider, and will assist you in constructing a dependable policy that's right for you.

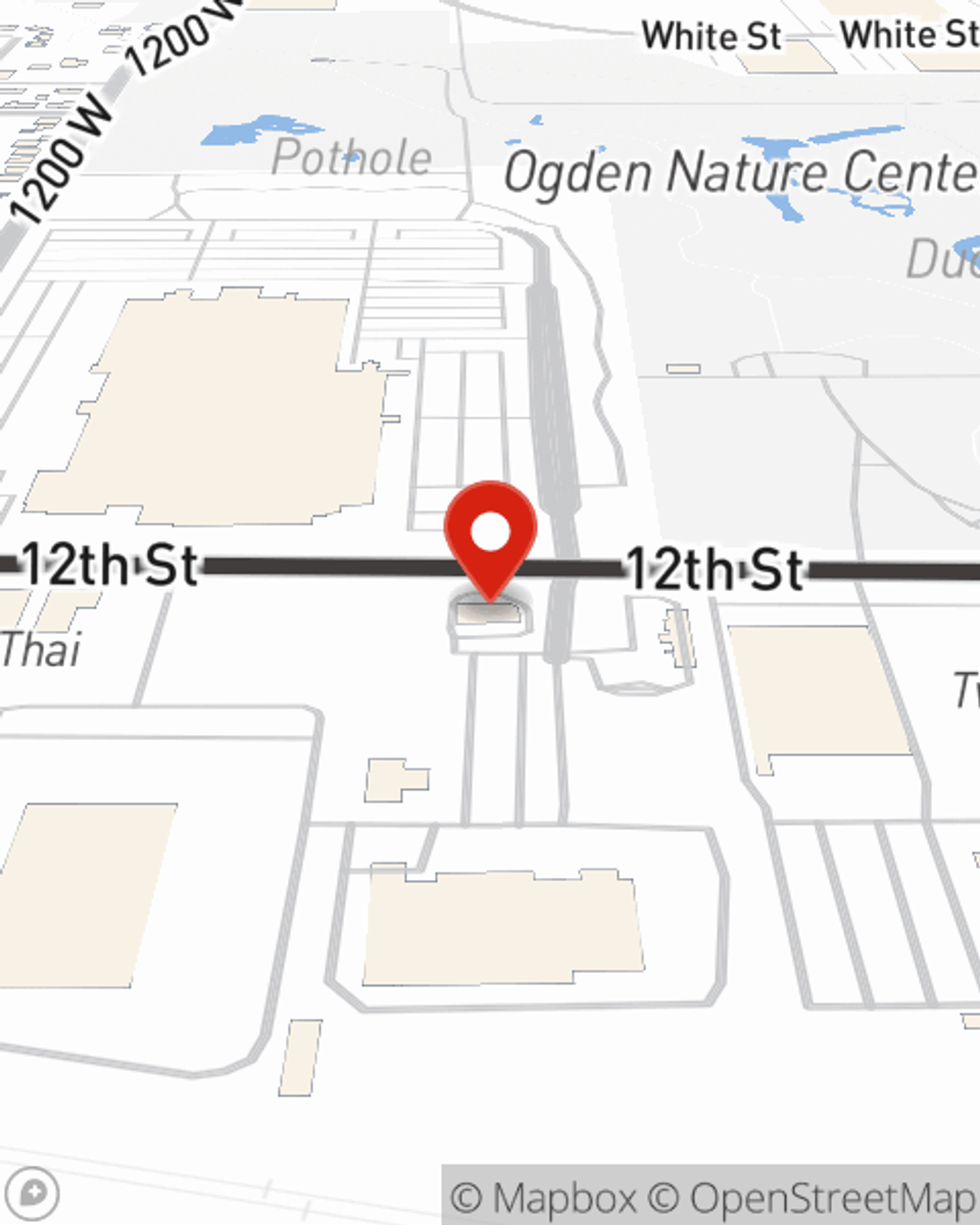

Ogden condo owners, are you ready to check out what a company that helps customers by handling thousands of claims each day can do for you? Get in touch with State Farm Agent Jay Carnahan today.

Have More Questions About Condo Unitowners Insurance?

Call Jay at (801) 394-2266 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Jay Carnahan

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.